The Flip Flop Fault Line Plus Nike Tech Group Layoffs And The Brand's U.S. Wholesale March

Plus, Sporty & Rich looks to level up

The Dogs Are Out And Barking: Havaianas and New York City-based LoveShackFancy, a brand founded in 2013 by Rebecca Hessel, have collaborated on a collection of floral flip flops, which have already sold out in almost all sizes.

Another collab wouldn’t normally register as a seismic event, and yet this one taps into a broader tectonic shift already disrupting the shoe landscape. A natural evolution of the low-profile sneaker trend, the flip flop signals that women are once again willing to bare their toes after years of covering up with sneakers, loafers, and mules.

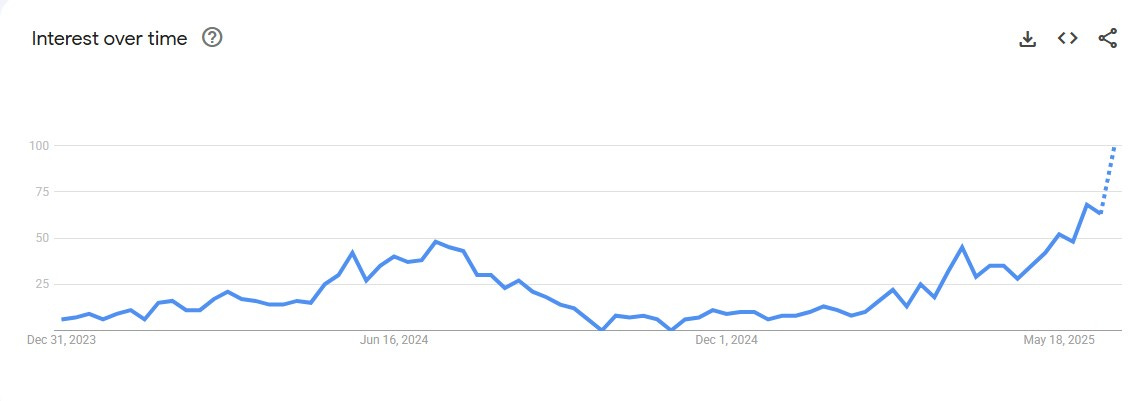

The flip flop’s comeback has been quietly building since last year, but it hit a tipping point in March when The New York Times spotlighted The Row’s sold-out $690 version. That piece triggered a deluge of shopping guides across major fashion sites and Substacks alike. Just yesterday, actor Jonathan Bailey showed up in a pair on a London red carpet, prompting GQ to debate whether flip flops now qualify as formalwear.

It may all seem inconsequential, but if women are sliding back into $50 rubber sandals, the real question is: what footwear are they not buying to make space for these three-point icons?

The flip flop revival hasn’t gone unnoticed by Havaianas’ São Paulo-based parent company, Alpargatas. In March, the company named Gigi Hadid as global brand ambassador, and recently inked an exclusive North American distribution deal with The Eastman Group. Alpargatas also owns 49% of Rothy’s, another brand thriving off women’s pivot toward low-heel Mary Janes and ballet flats.

Jefferies analyst Pedro Baptista, according to WWD, has a buy rating on Alpargatas whose stock is up 44% year to date. In a note, Baptista wrote that North America accounted for 4% of group revenues and 16% of international revenues in 2024. He went on to describe the partnership with Eastman as “key strategic step” in North America.

Tech’s Unraveling Continues: Nike last week quietly laid off a chunk of staff in its Global Technology division, according to reporting by Matthew Kish for the Oregonian. An email sent to employees indicated “some roles will change, and others will be eliminated” but the “majority of roles will remain the same.” Last year, according to the pub, Nike laid off 740 workers in Oregon as part of a companywide reorganization. The latest staff reductions in technology follow layoffs in the same division last month.

Some of the layoffs were likely tied to Nike’s pullback on nike.com and NFT initiatives that include the shuttering of RTFKT, but the division still appears to be reeling from the fallout of former Chief Technology Officer Ratnakar Lavu’s tenure. Referred to internally as “Ratt” (and not affectionately), Lavu joined Nike in 2019 after serving as Kohl’s chief technology and information officer. He resigned abruptly in March 2023, leaving in his wake a demoralized team and a lawsuit alleging he engaged in corruption, including vendor kickbacks, claims that reportedly triggered an SEC investigation.

Dr. Muge Dogan, former president of Amazon Fashion, now leads Nike’s Global Technology team. Hired in 2023, she’s viewed as a steadier hand than her predecessor, but anonymous posts on thelayoff.com suggest her leadership hasn’t moved swiftly enough to unwind the legacy of Lavu’s crony hires or refocus the division on core fundamentals. Under Dogan, the team may be out of crisis mode, but it hasn’t yet entered a true rebuilding phase, leaving morale in a precarious, unresolved state.

Nike’s Journey Back: While writing about Dr. Dogan, it occurred to me that it should’ve been obvious at the time that Nike would reopen its direct relationship with Amazon (more on how that’s going via my intervew with third-party seller Griffin Myers). But no, according to ChatGPT, no one at the time viewed her hire as foreshadowing Nike’s return to Amazon. Since Dogan was hired, Nike has reopened Macy’s, DSW, Shoe Show, Belk, Dillard’s, Urban Outfitters, while launching Jordan for the first time at Academy Sports.

I’m hearing one more shoe will drop in the form of Journey’s, which will welcome back Nike for holiday 2025 at the chain’s new 4.0 prototype stores, which currently number 17 and are forecasted to grow to 75 by year end.

Nike and Journey’s have long had a frosty relationship that predated the brand’s pullback from wholesale, but a lot has been repaired under the leadership of the chain’s president Andy Gray, who was announced in November 2023, following his role as Global President of Foot Locker. The Nike connection was further bolstered by Chris Santaella, Journey’s chief merchandising officer, who comes to the job from a role as senior vice president and chief product officer at Foot Locker.

It appears the only retailers that Nike hasn’t fully reopened are Big Five Sporting Goods and Dunham’s Sports, which carry the brand’s accessories and a smattering of apparel and an even smaller amount of footwear. Given Big Five and Dunham’s serve young athletes, that never made any sense to me, but there could be bigger things at play related to finances.

$30 Million Was Cute For A Minute: Sporty & Rich founder Emily Oberg visited the Business of Fashion’s podcast, where she was interviewed by Editor-in-Chief Imran Amed in a very thorough manner. Oberg has told her story a lot but Amed worked through her timeline in a very methodical way, clearly fascinated in part by their shared upbringing in Calgary, Alberta, Canada.

In the exchange, Oberg shared details about the brand’s early days, including its first drop under the leadership of her then-boyfriend, now CEO, David Obadia that raked in $40,000.

When COVID hit, Oberg told Amed that she didn’t think the brand would survive, but much to her surprise demand exploded, spurred in part by the growth in demand for cozy, stay-at-home ‘fits and bolstered by A-list influencers like Hailey Bieber, Rosie Huntington-Whiteley and Emily Ratajkowski, all of whom purchased the brand without being seeding. For one pre-order launch during COVID, the brand racked up an eye-popping $600,000 in sales, a level of demand that forced the company to upgrade production and the brand’s e-commerce site.

I’ve wondered since it opened two years ago how the brand’s Greene Street store in Manhattan’s SoHo has performed, just because the location is extremely expensive and on a block filled with much better known luxury stores, so not necessarily Sporty & Rich’s target. Defying my own expectations, Oberg said, “The store has done really well. It’s doing so well, we want to keep opening them; a store a year would be my ideal.”

She added the brand’s best categories remain “fleece and the merch,” though Oberg said she wants to “get away from that” and expand into new categories. Currently the company boasts a staff of 40, all based in Paris except for Oberg.

In the exchange, Oberg revealed the brand is now seeking outside investment for the first time. “We’ve never taken on any investors and it might be time for that.” She added, “If we want to expand retail, get a new audience and grow online, all of that stuff costs money. So I think that’s what I would want to do in the next year, probably bring on a new investor that can take it to a $300 million dollar a year brand. I think that would be a challenge for me; I know how to go from zero to $30 million, but 30 to 300 is a different beast.”

Complex Loses A Consigliere: Journalist Brendan Dunne has stepped down from his role at Complex, where he was employed for 11 years. Dunne reported on the sneaker space and was known for breaking multiple news stories. He was also part of the “Complex Sneaker Podcast,” and was also a panelist for the platform’s famously spicy “Sneaker of the Year” panel.

Dunne announced the news on X, where he told followers he will remain in the sneaker industry: “Decided two weeks back that after almost 11 years in that it was time to leave Complex; today was my last day at the company. If you supported anything we worked on, please know that I appreciate it. It’s been a pleasure. Sneakerman activities will resume at the big new job I’m starting next month.”

My totally uninformed guess is Dunne is going to Nike where he’s known for having a lot of connections. However, given Nike’s well-documented trevails, I could also see him landing at New Balance, whose revenue growth has been much more positive.

Tough Timing For Sneaker Retail Reentry, But What Do I Know: Erik Manzano Fagerlind announced on LinkedIn that he’s back as CEO at Sneakersnstuff. In the post, he thanked German venture capital firm Reziprok, which purchased the chain shortly after it declared bankruptcy in January 2025.

Fagerlind indicated the brand would focus on reestablishing physical retail. “We will double down on our physical presence in our key cities Stockholm, London, Paris, Berlin & New York + more cities that will be added along the way,” he said.

Currently, the sneaker retailer operates stores in Berlin, London, Stockholm and Paris. Sneakersnstuff closed its New York, Los Angeles and Tokyo stores in 2024.