Interview: What Nike’s Amazon Pivot Looks Like To A 3P Seller

Ponderosa Commerce founder Griffin Myers breaks down what Nike’s return to Amazon means for sellers like him.

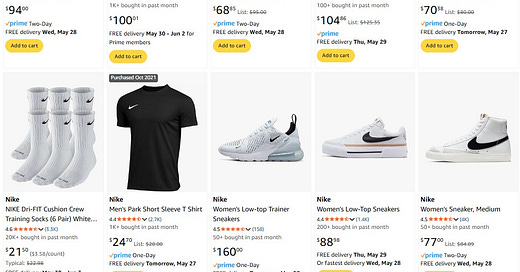

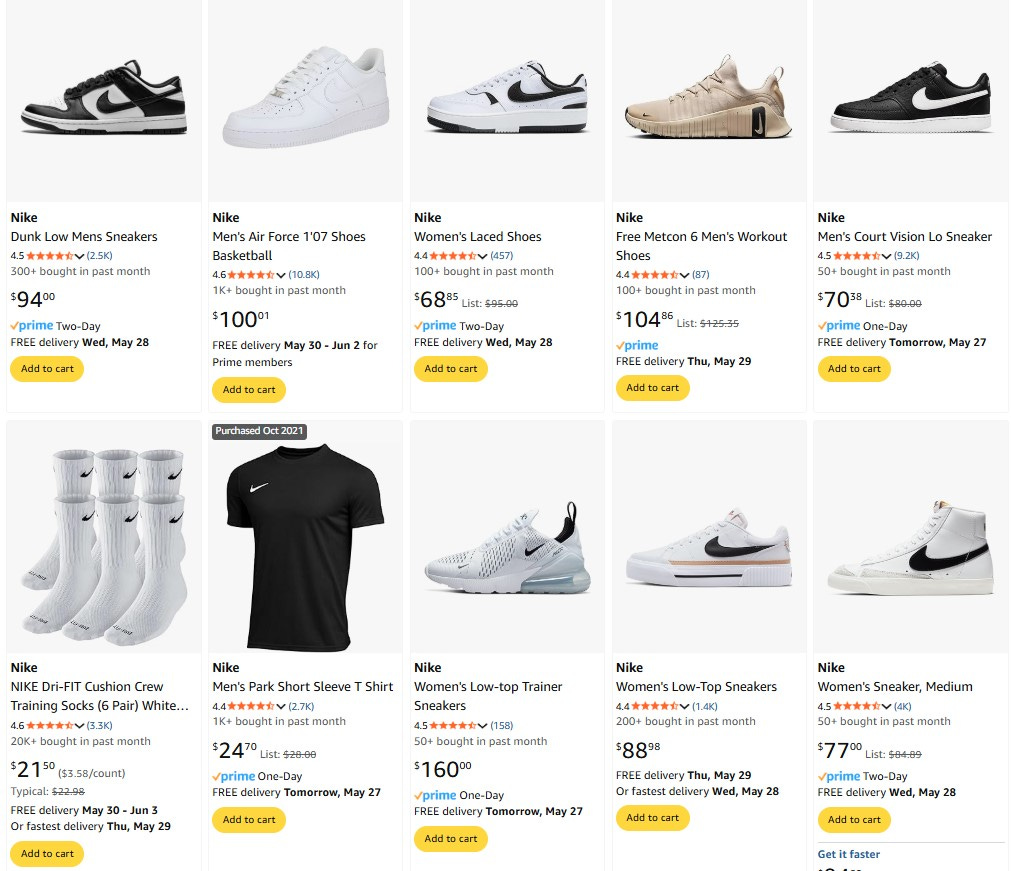

Nike made headlines last week when it announced it would resume a direct relationship with Amazon, with the partnership set to launch in July. Ahead of the launch, Amazon is alerting third-party sellers that certain products will be pulled starting July 19, 2025.

While it didn’t generate the same buzz, Adidas entered a similar direct relationship with Amazon this spring, notifying third-party sellers back in March.

To get a sense of how this impacts sellers, I caught up with Griffin Myers, founder of Ponderosa Commerce, who’s been selling sneakers on Amazon for years. With brands like Nike stepping back from direct sales, Ponderosa is shifting gears—moving away from reselling to helping brands build and manage their presence on Amazon and other e-commerce platforms.

Myers has been in the game for a while. He started online arbitrage at 12, selling bumper stickers on eBay. By high school, he was flipping sneakers—200 to 300 pairs a month as a senior in 2021. That hustle scaled to over $1 million in sales in 2024—all while finishing his degree at the University of Colorado Boulder.

Nike, for its part, has been steadily rebuilding wholesale relationships it had previously walked away from. That reversal began in June 2023, when Macy’s announced Nike was back. Since then, the brand has reopened ($$) with Urban Outfitters, Belk, Shoe Show, and recently made its debut at Aritzia. There are also whispers of a reunion with Journeys, a retailer Nike hasn’t sold to in more than a decade.

Check out my full exchange with Myers below:

How long has Ponderosa Commerce been selling on Amazon?

Griffin Myers: “We've been active in third-party marketplace sales for over eight years, with a dedicated focus on Amazon for the past four. From 2017 until now, we sold Nike products across platforms including StockX, GOAT, Amazon, eBay, and through wholesale channels. Today, Ponderosa Commerce has evolved into a strategic partner for brands—focused on driving growth, management, and mitigating risk across e-commerce platforms.

“We’re phasing out third-party retail. We’re making the pivot, we’ll bring you on to Amazon and Walmart and manage your brand. We work with brands and help them identify and get rid of third party sellers the right way. We can handle fulfillment for you. We do everything end to end.”

The last time Nike sold direct to Amazon, it only sold current season product. Third party sellers could sell everything else. From what you can see, will the rules be the same this time around?

Griffin Myers: “For now, it's unclear. Adidas, which announced a similar message on Amazon, sells current season products and allows third party sellers to sell prior seasons. I anticipate Nike will follow a comparable path—gradually reducing the number of SKUs available to third-party sellers, if not phasing them out entirely. Of the 250 Nike products I currently sell, I've been notified that 16 will cease as of July 19, 2025. I expect that number to grow over time.”

Nike and Amazon allegedly fell out the last time because Nike wouldn't sell Amazon premium product like Air Max and Retro Jordan. This time around do you think Nike will open up the catalog?

Griffin Myers: “Although no official announcement has been made, I anticipate that Amazon will eventually open its distribution channel to include Air Jordan and other premium Nike products. While it's unlikely we’ll see limited or high-demand releases, I expect general-release Air Jordan products to become available. Historically, Air Jordan has performed well, though it's also been more susceptible to fraud. Converse—also owned by Nike—will likely follow a similar path.”

Do you have any sense of how much Nike will make on Amazon?

Griffin Myers: “Nike will make money hand over fist. I know some sellers pushing $10 million a year on Amazon, selling 60% Nike, all legit. It's another massive channel for Nike and will only improve with better Amazon listing quality.”

Do you envision Nike third-party sales continuing on the platform?

Griffin Myers: “Amazon will have the final say, it governs the marketplace. In the case of Adidas, Amazon sent a letter to sellers on March 11, 2025 with a cut off day of May 11th.”

Bigger brands usually have very strict policies about who can and cannot sell on Amazon. I think of Decker Outdoor Corporation, which has a reputation for being very controlling about third-party Amazon sales.

Griffin Myers: “Maybe Ugg, but I don’t think that Hoka places a priority on e-commerce brand control. There are at least 100 different 3rd party Hoka sellers on Amazon, so it’s not as exclusive as you think.”

What will happen to third-party Amazon sellers?

Griffin Myers: “They either have to stop selling Nike or find another place to sell it. After the hard gate on Adidas on Amazon, I’m seeing sellers push more Adidas product on TikTok Shop.”

Given Adidas went direct first, how are third-party sellers selling the brand faring on Amazon at the moment?

Griffin Myers: “It’s a slow decline and getting more marginal by the day. Since the hard gate there are fewer sellers on the platform. It's naturally dwindling out.

What about apparel?

We never did much with apparel, it’s very costly to sell because there are lots of returns. Footwear is the same, it’s a 15%-20% return rate, which just eats your margin. Normal [consumer packaged goods] product like, say, vitamins, the return is 3%.”

What about Walmart?

Griffin Myers: “Walmart is about a tenth of Amazon at best. It’s investing a lot in Walmart Plus, so it makes a bigger effort to be more inviting to sellers.”

Nike is currently focused on reducing direct sales of franchise shoes like Air Force 1, Dunk and Air Jordan 1. Are you seeing pricing increase on those models yet?

Griffin Myers: “We’re still seeing historical lows on Nike Dunks and Air Force 1s. The best example is Nike’s Dunk Low Panda [grade school sizing]. In 2021, prices peaked near $300. Today? A mere $30.

“I personally think the damage has been done and it’s going to take a few years for pricing to rebound. Nike got too confident and cocky about how much it could sell. Because of stimulus money, demand was off the charts in 2021 and then from 2022 onward, it was a consisent slide downward.”

Why are you transitioning out of reselling?

Griffin Myers: “I’m at the point I never want to see another pair of shoes in my life. We have a warehouse now, but for five years my family’s basement was full of shoes. I personally shipped out 10,000 units. There are bigger and better things. Our company has so much Amazon expertise, we have that edge and can offer so much than other agencies.”