Tyshawn Takes Supreme to Court, Nike’s HON Is Gone, NikeSKIMS Is Late and Skechers Gets Scooped by 3G

Finance: UA, ONON, WWW

Tyhawn’s $26M Supreme Showdown

Well this isn’t pretty. Twenty-six-year-old skateboarder Tyshawn Jones, who’s been a member of Supreme’s skate team since he was 13, has sued the retailer for $26 million, claiming he is owed money for the termination of his $1 million-a-year sponsorship deal, as well as damages to his reputation.

“I am saddened it has come to this, but I have a duty to myself and my career, and feel a responsibility to the next generation of skateboarders to stand up for what is right,” the well-regarded skater told the New York Post in a statement. Supreme hasn’t commented on the suit.

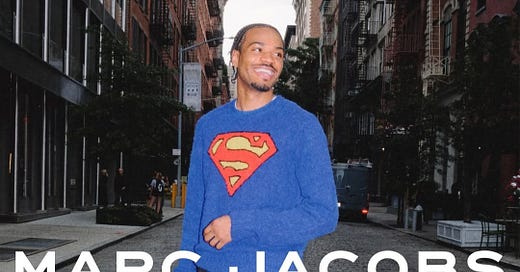

According to the lawsuit filed by Jones’ team on Monday in Manhattan Supreme Court, Supreme ended the deal last September, telling “multiple third parties” he had violated his contract when he appeared in an ad for Marc Jacobs featuring a Nigo collaboration. The suit points out that Jones had previously modeled for Balenciaga, Louis Vuitton, and Tiffany & Co. without any pushback from Supreme.

Jones’ suit alleges that Supreme dumped him not because of the MJ ad but because the retailer was looking to slash costs prior to its sale to EssilorLuxottica in October 2024.

In February, Jones was named a Louis Vuitton “Friend of the House,” an announcement accompanied by video of him skateboarding in a monogram-covered ‘fit and ultimately jumping over a set of trunks. Given his skate-based connection to Supreme and the brand’s territorial reputation, the ad spurred me to snoop around to see if Jones was still with the team. Apparently he wasn’t.

Nike Slams Door On DTC Era Ends With Heidi O’Neill’s Exit

Nike’s president of consumer, product, and brand, Heidi O’Neill, has officially stepped down, she will remain as an adviser until September. Positioned alongside Craig Williams, president of geographies and marketplace, as a contender to succeed CEO John Donahoe, the writing was on the wall the moment Donahoe announced his own departure.

A 26-year veteran of the brand, O’Neill was never a favorite among Nike employees (thelayoff.com thread subject simply reads “HON is GONE!!!” and is filled with celebratory comments) or wholesale accounts, many of whom have expressed their distaste for her directly to me. Much of the criticism was rooted in her leadership of Nike’s direct-to-consumer strategy, a failed effort launched under Donahoe that aimed to reduce Nike’s wholesale presence while boosting higher-margin direct sales.

Among Nike’s number crunching consultants, initially it must have seemed like the best idea ever!!—a delusion fueled by Nike’s still high brand standing combined with Covid customers who were locked inside and flush with cash. But it all came crashing down post pandemic when customers began returning to shopping at stores.

Personally, I always wondered what analyst concluded a significant portion of low-income, stressed out Moms would walk into DSWs, not find the Nike sneakers they were seeking, leave the store empty-handied and go home and buy pairs from Nike online.

O’Neill, whose 2024 base salary was $1.3 million plus $5.22 million in stock awards, will not be replaced. Instead, her responsibilities will be split among three leaders who will report to new CEO Elliott Hill.

Amy Montagne, a 20-year brand veteran and former vice president and general manager of global women’s, has been promoted to president of Nike brand—though some employees on thelayoff.com are already questioning why someone whose division struggled enough to require a Skims partnership is being promoted.

Phil McCartney, a 27-year veteran and former vice president of footwear, has been named executive vice president and chief innovation, design, and product officer.

Nicole Graham, formerly chief marketing officer, is now executive vice president and chief marketing officer, overseeing demand creation for Nike, Jordan, and Converse.

Williams, meanwhile, keeps his role as president of geographies and marketplace, seemingly untouched by the shakeup, for now anyway.

NikeSkims Is Staffing Up, Spring Launch Is MIA

Nike and Skims announced their brand partnership back in February, promising a spring 2025 launch. With spring nearly over, there’s still no sign of NikeSkims. That’s not to say something couldn’t drop any day, but sources tell me the brand isn’t quite ready.

Over on LinkedIn, NikeSkims is actively hiring, looking for a Los Angeles-based designer and four Beaverton-based roles including a planner, developer, and designer.

Some of the team members already in place include:

Jordan Mills, head of operations

Trelawny Davis, senior director of global brand marketing

Katie Alvarado, senior director of merchandising

Tracy Romulus, co-general manager of NikeSkims and executive VP of communications and entertainment at Skims—yes, very much that girl.

I can’t share it but I’ve seen an early catalog image of a NikeSkims top and bottom that appear to be part of a fall collection. The pricing seems accessible (the jacket is priced at $78), but without more context, it’s hard to judge. Honestly, I don’t expect to be wowed by the designs themselves—Skims’ real magic lies in its innovative textile and color stories that resonate with millennials and Gen Z.

A 26-Year Run as a Public Company Comes to an End

Just a week after its earnings report, Skechers stunned Wall Street by announcing last Monday that it would be acquired by 3G Capital, a global investment firm founded in 2004 by Brazilian financiers Jorge Paulo Lemann, Marcel Herrmann Telles, and Carlos Alberto Sicupira. 3G is paying $63 per share—valuing the deal at $9.5 billion, a 30% premium on Skechers’ 15-day volume-weighted average stock price. Shares jumped 25% to $61.56 on the news. CNBC reports that 3G had been eyeing Skechers for years, and tariffs didn’t factor into the negotiations at all.

Skechers will continue to be led by chairman and CEO Robert Greenberg and his management team, with headquarters remaining in Manhattan Beach, California. The deal is expected to close in Q325.

When I asked a sharp C-suite executive why Greenberg might be selling now, he pointed out the obvious—Greenberg is 84. Selling allows him to step back without triggering the stock punishment Wall Street would have likely delivered if he had announced his retirement outright.

Now, freed from the scrutiny of financial analysts, Skechers can discount (and right now, it’s holding a rip-roaring spring sale on skechers.com), raise prices, or follow Reebok’s playbook by licensing the brand to retailers like TJ Maxx. This would allow the brand to expand its reach without having to manage production or deal with tariffs.

Within sneaker culture, Skechers is often seen as a non-factor, yet the company reported $9 billion in revenue and $640 million in net earnings in 2024. Nike and Adidas are much bigger at $51.4 billion and $25.6 billion, respectively, but Skechers holds a solid third place, outpacing Asics ($4.5 billion), On ($2.63 billion), Reebok ($2.3 billion), Hoka ($1.81 billion), and Brooks Running ($1.3 billion).

Keep reading with a 7-day free trial

Subscribe to Snobette News to keep reading this post and get 7 days of free access to the full post archives.