Running by the Numbers: The Popularity Contest (Part 1)

A look at brand rankings in the hot-as-a-potato running space, according to the people most invested in the category

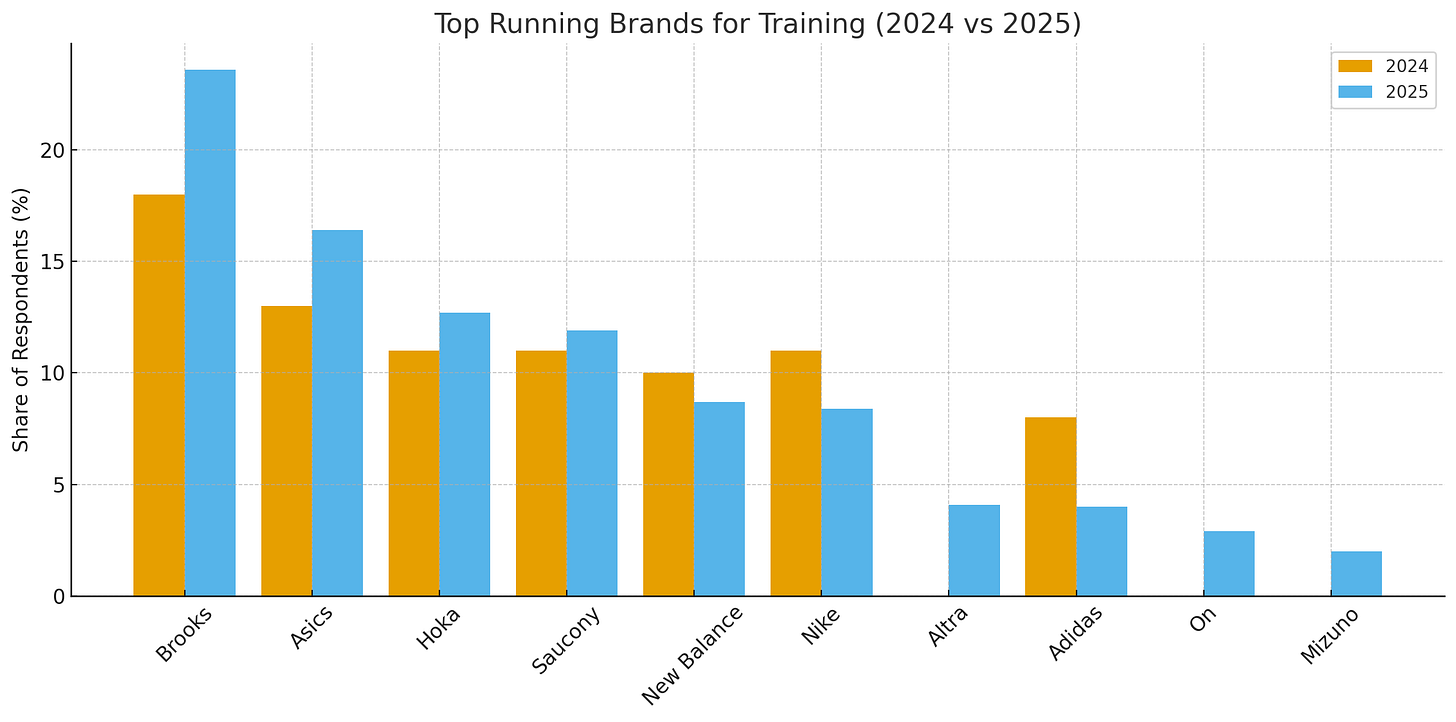

Running USA’s 2025 Global Runner Survey, covered recently by SGB Media, captured responses from more than 12,700 runners worldwide between March and July 2025 — a 73% jump from the prior year and, for the first time, with 10% of participants based outside the U.S. Nearly all respondents (95%+) identified as runners or joggers, so one has to assume this is a very dedicated crowd that cares mores than most about their shoe and apparel choices. The chart below highlights how brand preferences shifted from 2024 to 2025 across both training and race-day shoes.

Things that stood out for me in training:

Brooks never lost its No. 1 spot, but it roared back in 2025. That lines up with the brand’s 2Q25 earnings update, where North American sales rose 13% year over year and every global region delivered double-digit growth. Brooks called out its Glycerin line (up 27%) as the main driver, with Ghost (+16%) and Ghost Max (+82%) also surging.

Nike has been pouring its heart into reviving performance r…

Keep reading with a 7-day free trial

Subscribe to Snobette News to keep reading this post and get 7 days of free access to the full post archives.